Factor Augmented Vector Autoregressive

A factor augmented vector autoregressive favar approach quarterly journal of economics 2005 v1201feb 387 422.

Factor augmented vector autoregressive. A main focus of the chapter is how to extend methods for iden tifying shocks in structural vector autoregression svar to structural dfms. Bernanke ben s jean boivin and piotr eliasz. Users who downloaded this paper also downloaded these. Factor augmented varma models with macroeconomic applications.

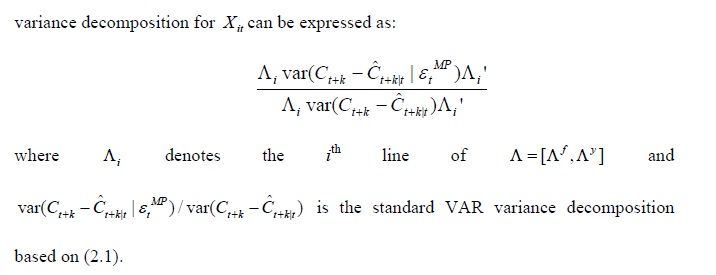

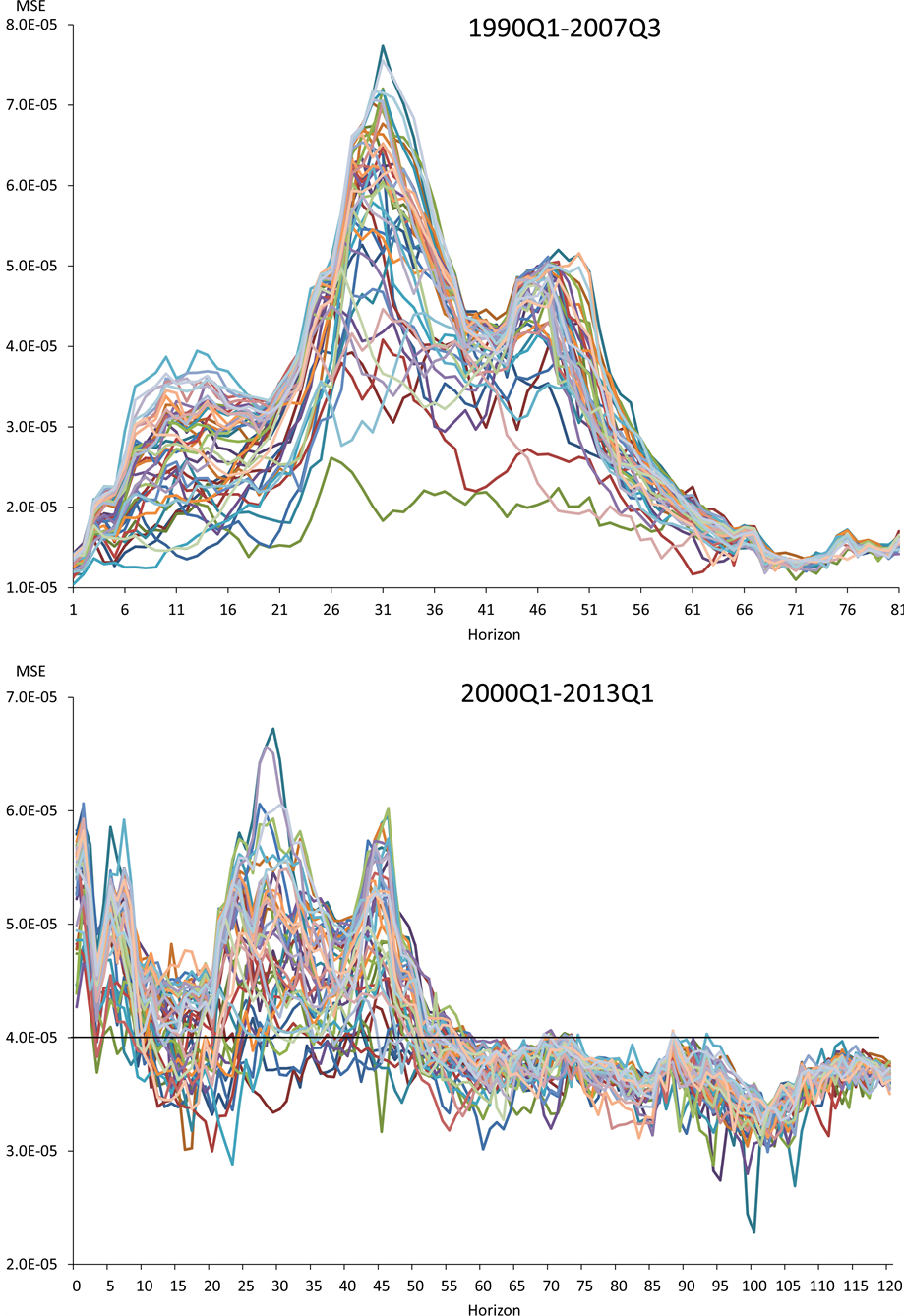

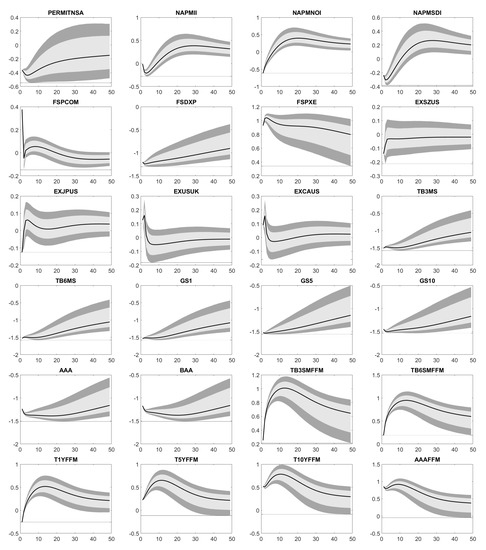

This chapter provides a thorough introduction to panel global and factor augmented vector autoregressive models. These models are typically used to capture interactions across units ie countries and variable types. There is thus a direct mapping into the existing var results and 21 provides a way of assessing the marginal contribution of the additional information contained in ft. We use factor augmented vector autoregressive models with time varying coefficients and stochastic volatility to construct a financial conditions index that can accurate.

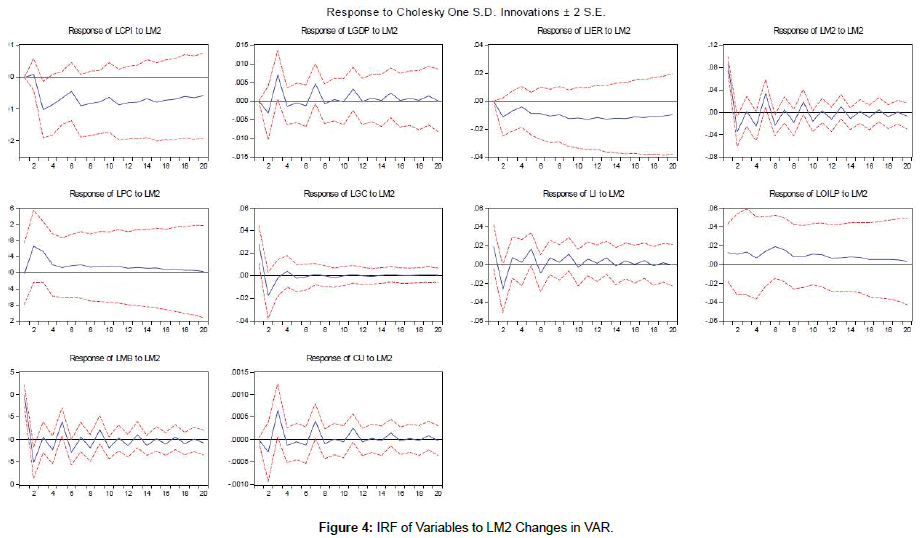

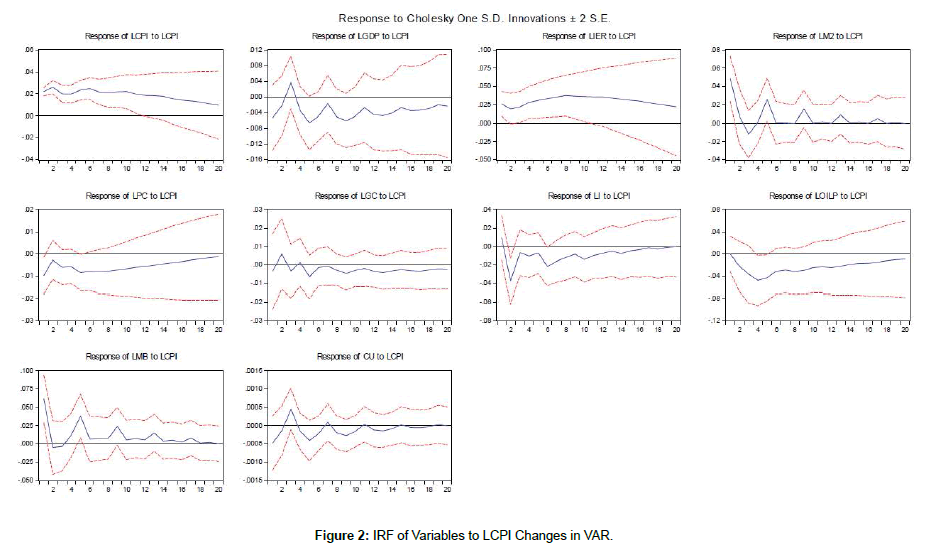

Citation courtesy of. Factor augmented vector autoregression models have been introduced into the economic literature in order to solve the issues that have been raised during a wide number of studies on the effect of. Obtained the findings in this paper namely var model results impulse response functions showed that partially work of the interest rate channel in turkey and of the exchange rate channel in mexico. We study the relationship between varma and factor representations of a vector stochastic pro cess.

Analysed for both countries using the var vector autoregressive and favar factor augmented vector autoregressive econometric methods. Ytif the terms of fl that relate ytto ft1are all zero. Out the use of dfms for analysis of structural shocks a special case of which is factor augmented vector autoregressions favars. Otherwise we will refer to equation 21 as a factor augmented vector autoregression or favar.

I am attempting to use the two step approach to factor augmented vector autoregression as outlined in the seminal paper by bernanke and his colleagues. Factor augmented vector autoregression in stata. Instead a var factor dynamics induces a varma process while a var process. Measuring the effects of monetary policy.

After reviewing two mature applications of dynamic factor models forecasting and macroeconomic monitoring the chapter lays out the use of dynamic factor models for analysis of structural shocks a special case of which is factor augmented vector autoregressions.