Support Vector Machine Regression For Volatile Stock Market Prediction

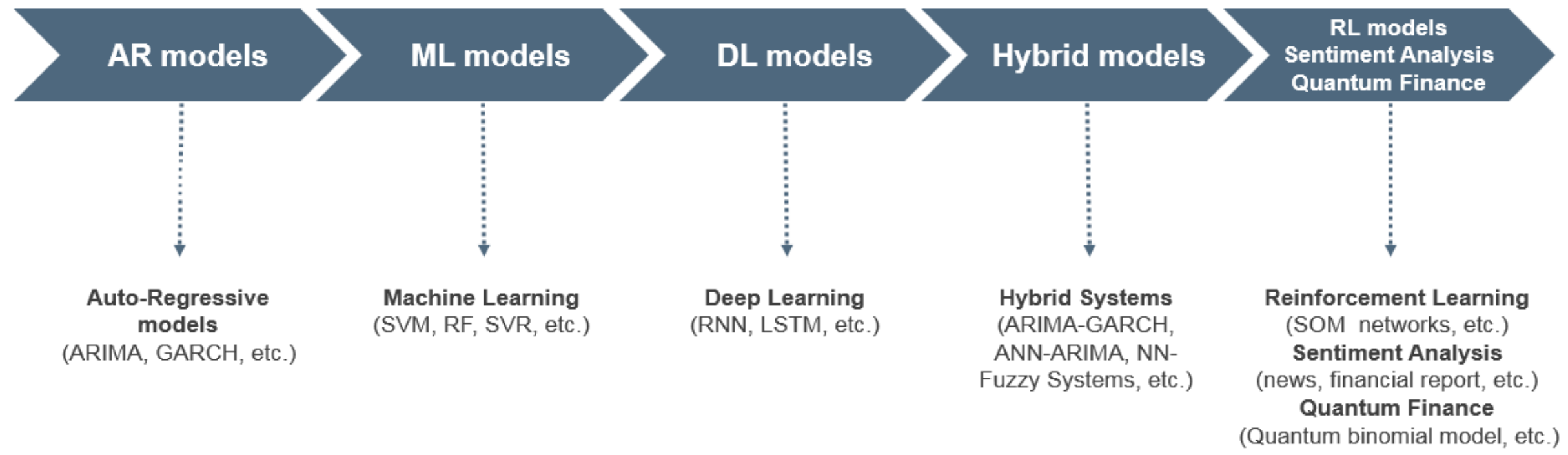

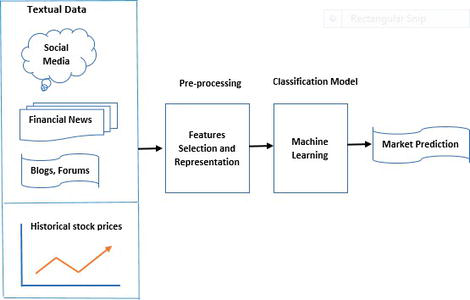

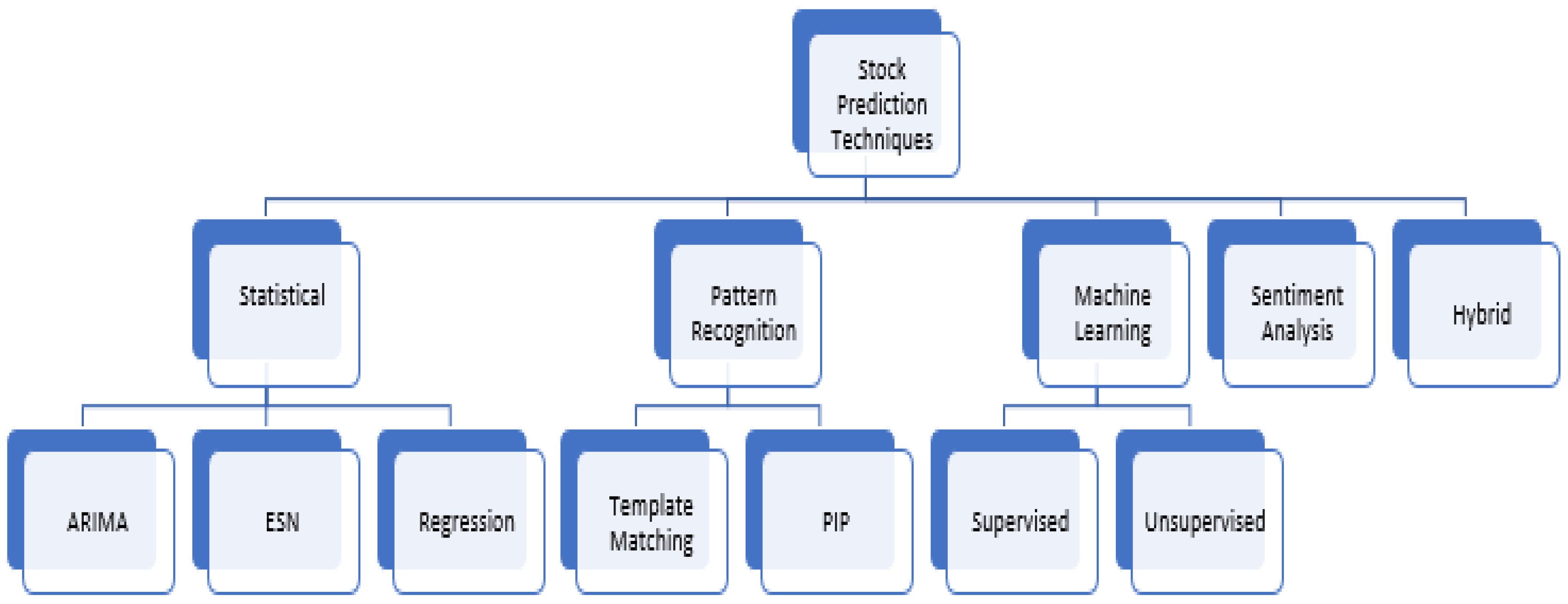

Support vector regression svr machines are one of the most powerful machine learning techniques and has been widely used with excellent results in many realworld problems such as stock market.

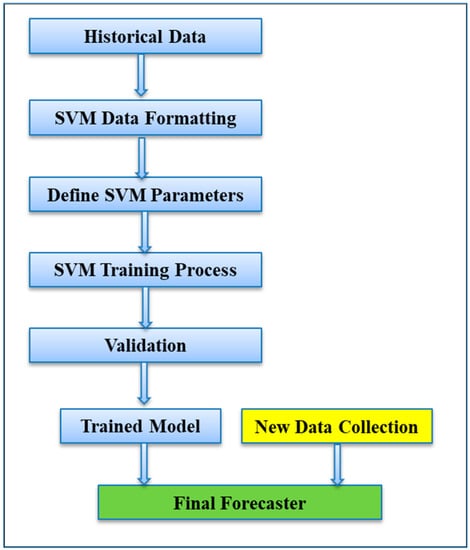

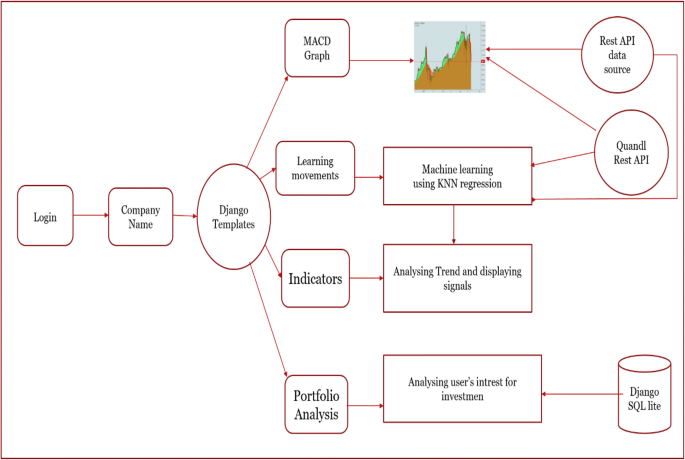

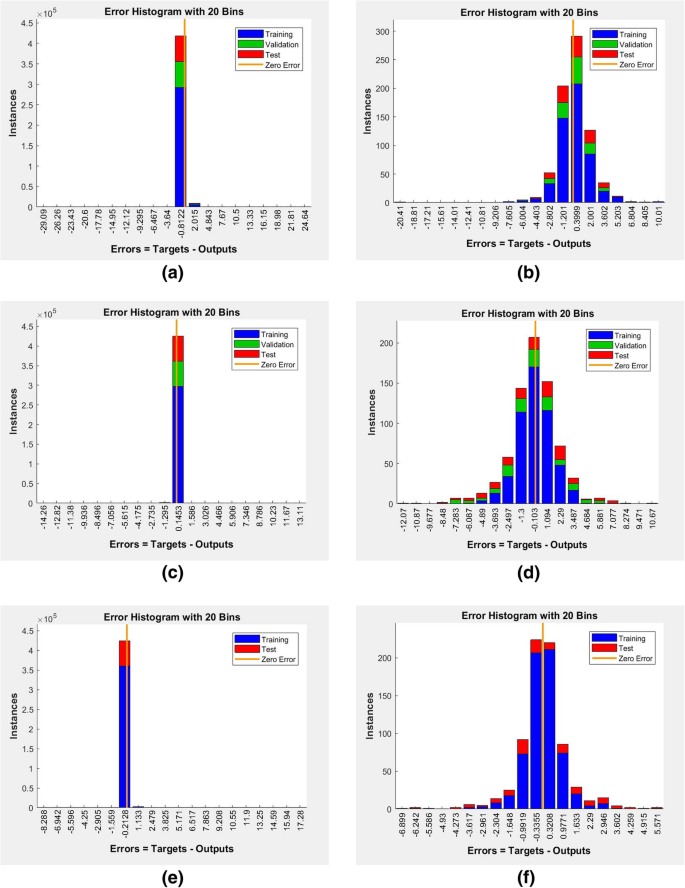

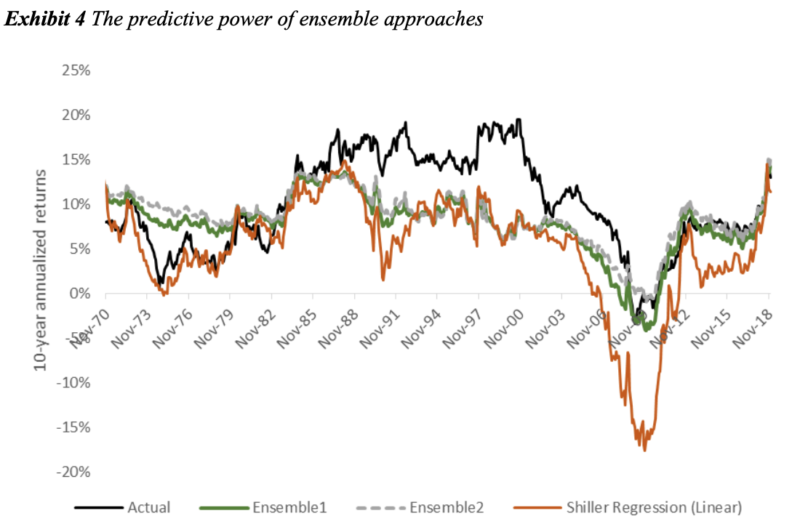

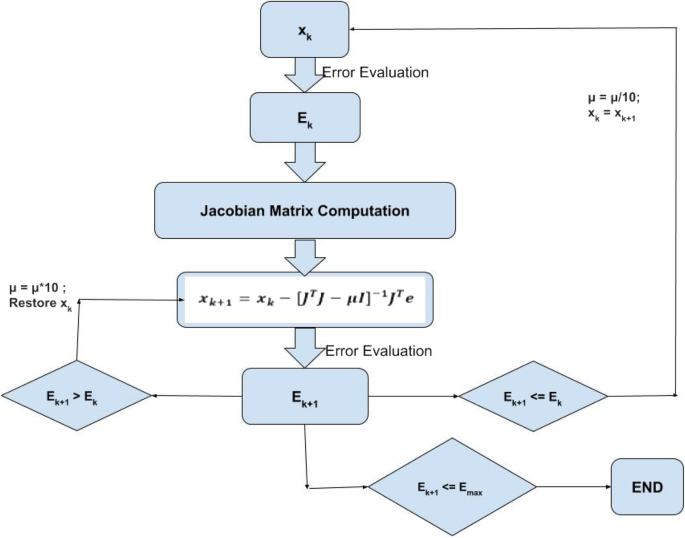

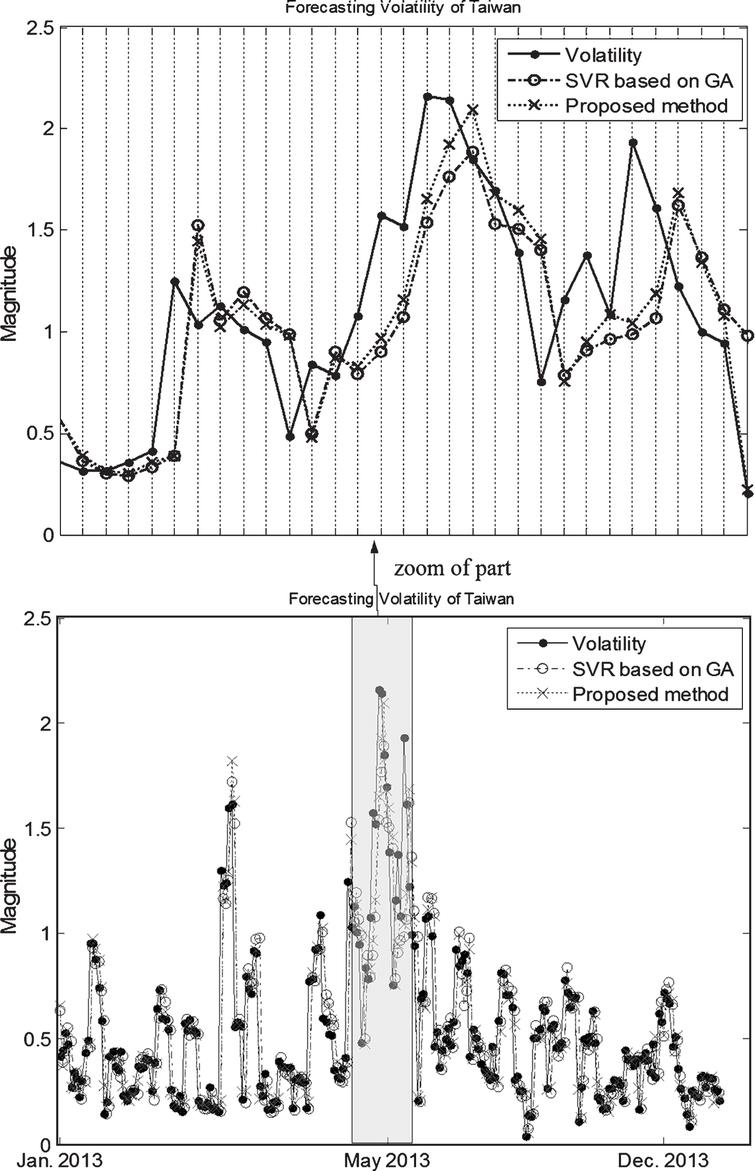

Support vector machine regression for volatile stock market prediction. Recently support vector regression svr has been introduced to solve regression and prediction problems. In particular the financial data are usually noisy and the associated risk is time varying. Gfxiyi 1 2 w w2 support vector machine regression for volatile stock market prediction 393 wherecis a pre specied valueg is a cost function that measures the empirical risk. In this paper we apply svr to financial prediction tasks.

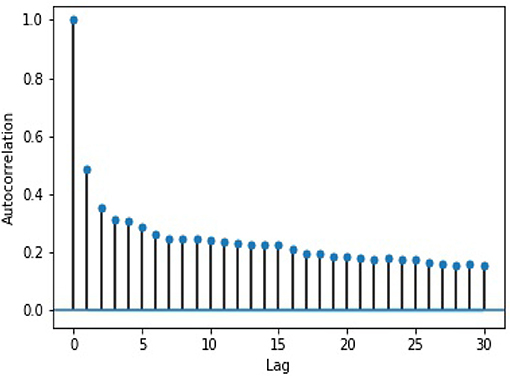

In general thee insensitive loss function is used as the cost function. Support vector machine is a machine learning technique used in recent studies to forecast stock prices. In particular the financial data are usually noisy and the associated risk is time varying. Recently support vector regression svr has been introduced to solve regression and prediction problems.

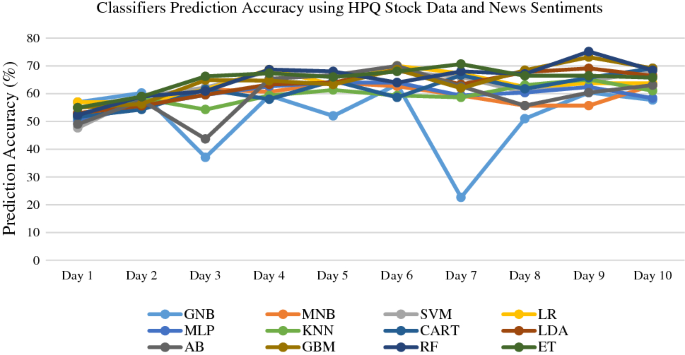

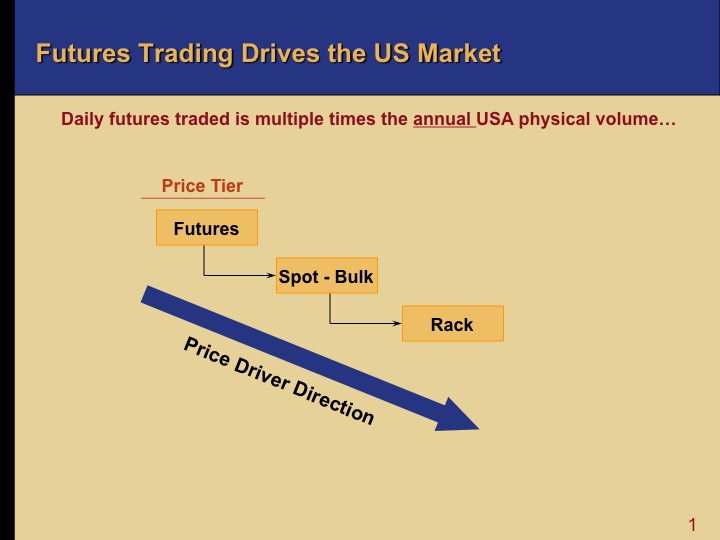

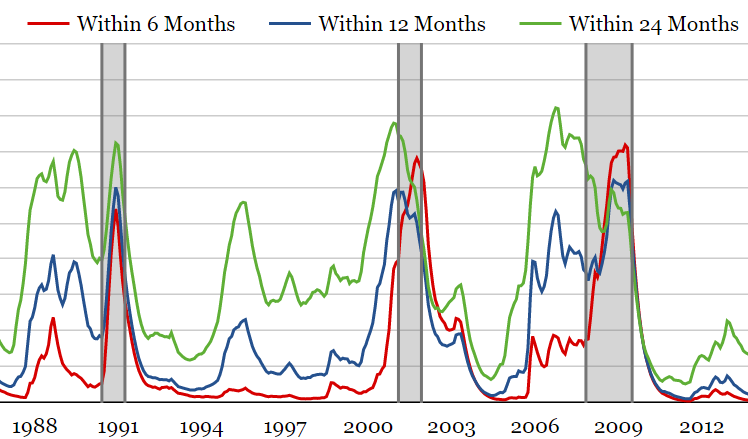

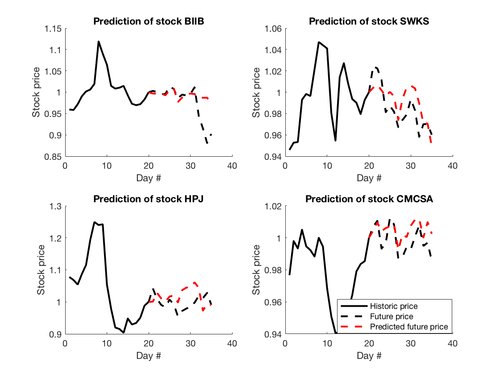

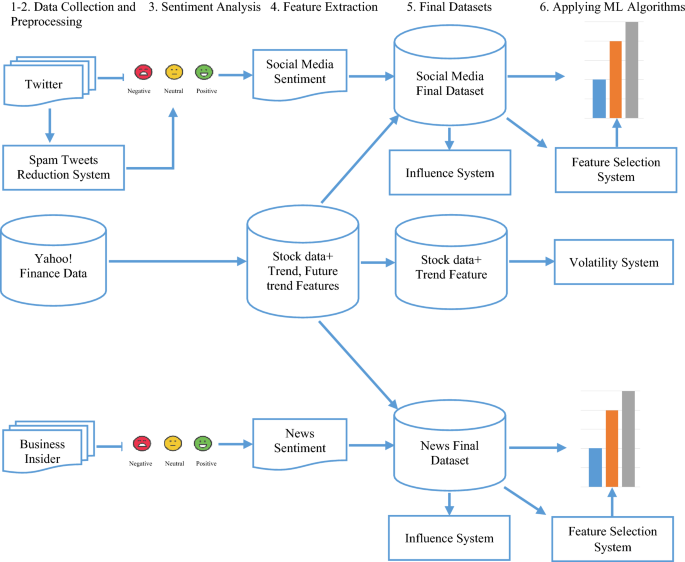

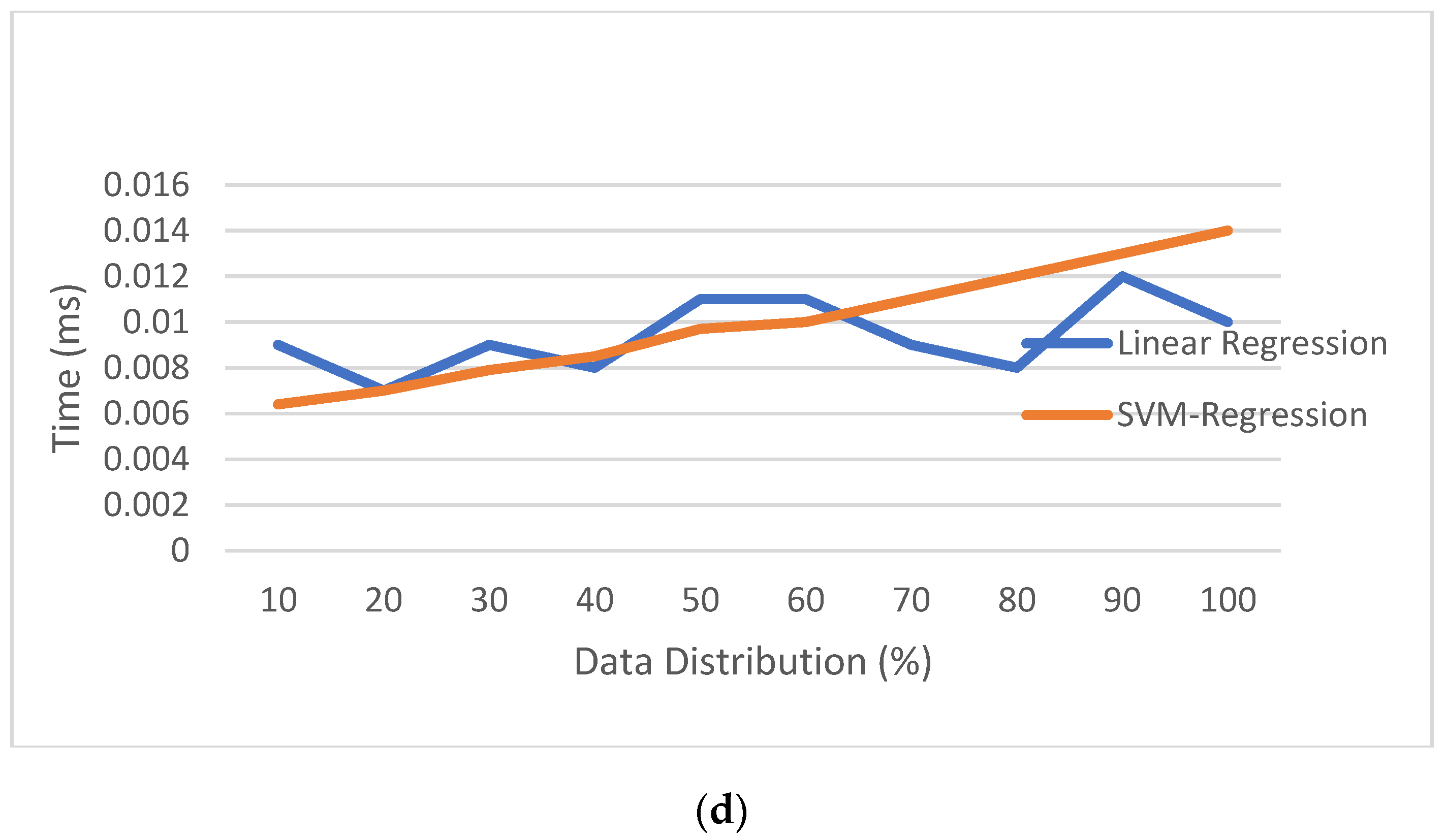

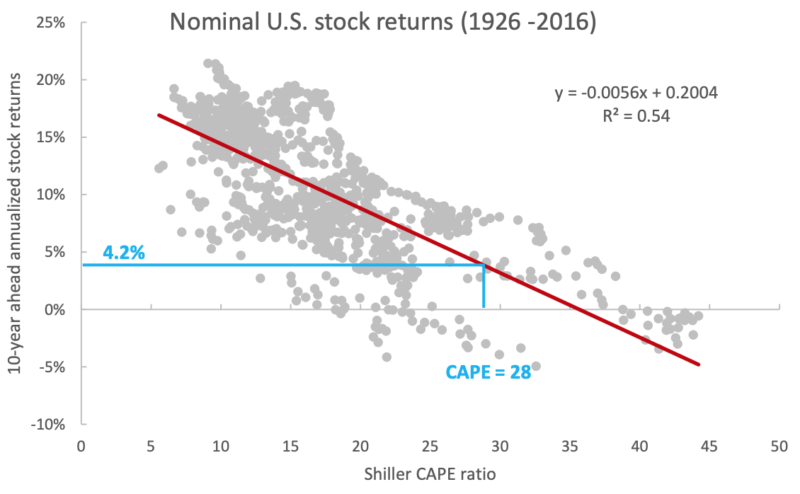

This study uses daily closing prices for 34 technology stocks to calculate price volatility and momentum for individual stocks and for the overall sector. The theoretical formulations of rough support vector machines rough support vector regression and rough support vector clustering are supported with a summary of experimental results. In this paper we apply svr to financial prediction tasks. These are used as parameters to the svm model.

In this context this study uses a machine learning technique called support vector regression svr to predict stock prices for large and small capitalisations and in three different markets employing prices with both daily and up to the minute frequencies. Support vector machines svm analysis is a popular machine learning tool for classification and regression it supports linear and nonlinear regression that we can refer to as svr. I this post i will use svr to predict the price of td stock td us small cap equity i for the next date with python v3 and jupyter notebook.